Today, a majority of consumers are experiencing some sort of financial difficulty causing a significant impact on their everyday lives. In fact, Americans carry more than $2 trillion in consumer debt and 30 percent of consumers report having no extra cash; making it impossible to escape the burden of living paycheck to paycheck.

April has been declared National Financial Literacy Month; and for good reason. Too many Americans are insufficiently educated about their personal finances.

The first and most important step in developing and following a financial plan is to examine your attitudes about money. Are you ready to accept responsibility for changing your financial situation? Do you believe that you can and will change the way you make financial decisions? Can you identify at least one benefit you hope to gain by changing your money management behavior? (http://www.financialliteracymonth.com/)

How to Keep a Budget

As soon as you start spending your own money, it’s time to start tracking your spending so that you can create and follow a personal budget. Keeping track of expenses, while sometimes tedious, is the best way to find out exactly where your money is going.

The simplest way to keep track of your finances, especially your cash, is the low-tech way, with a notebook and a pen. By carrying around the notebook with you, you can track exactly where every dollar is going–from a small coffee on your way to work to a spending splurge at the mall. If you’d prefer, on a daily or weekly basis, you can transfer your handwritten notes to a computer spreadsheet.

Once you have collected information for about a month, you’ll have a good baseline of information to use to create your personal budget. Some major categories that you’ll want to include are housing, utilities, insurance, food (groceries and dining out), gasoline, clothing, entertainment, and “other”. Using a spreadsheet program (such as Excel), online service, or other personal finance program, add up the expenses that you’ve been tracking, and then calculate what you’d like to budget for each category. Keep in mind that you’ll need to budget for some items, like gifts and automobile repairs, which will be necessary but won’t occur every month. You can either create a budget for each individual month, with variances for irregular expenses (e.g., heating expenses which will be higher in winter months, or car repairs and gifts), or a standard monthly budget where you include an average amount for expenses such as car repairs, heating, and gifts.

Your budget should also contain some personal savings amounts for retirement savings, college savings, an emergency fund, long-term savings, and any other savings goals you may have. Don’t wait until the end of the month to see what’s left – budget for your savings first.

Creating a personal budget is a good first step, but the most important thing is to follow the budget. Make time weekly or monthly to track your spending, and start to see if you are actually keeping to your budget. Using a personal finance program or an online service is probably the easiest way to do this on an ongoing basis, but make sure you continue to track where your cash is going. You may be surprised to find out how the frequent small amounts you spend actually add up to big money.

After tracking your personal budget, you may notice some areas where you’ll have to make changes. Don’t just increase your budget without considering alternatives. While you may have no choice, if prices or expenses go up, shop for better deals before giving in to the extra expenses.

Resources:

https://www.fdic.gov/consumers/consumer/moneysmart/index.html

https://www.fdic.gov/consumers/consumer/moneysmart/young.html

https://www.fdic.gov/consumers/consumer/moneysmart/olderadult.html

https://www.fdic.gov/consumers/consumer/moneysmart/business.html

https://www.moneymanagement.org/Budgeting-Tools/Credit-Articles/Money-and-Budgeting/Make-a-Personal-Budget-and-Keep-Track-of-Spending.aspx

https://www.moneymanagement.org/Community/Blogs/Blogging-for-Change/2009/April/FLM-Step-2-Gerri-Detweiler-discusses-the-importance-of-assessing-your-financial-situation.aspx?RCTAG=FLM

https://www.moneymanagement.org/Budgeting-Tools/Credit-Articles/Money-and-Budgeting/Five-Things-You-Need-to-Know-About-Money-and-Personal-Budgeting.aspx

Ms. Burton is Founder and Executive Director of A New Way of Life Re-Entry Project. Her non-profit provides women ex-offenders a home and helps them stay drug-free, find work, and reunite with family. The organization has provided direct service to over 1,000 women. Ms. Burton was inspired to start the organization after serving multiple drug sentences and turning her life around.

Ms. Burton is Founder and Executive Director of A New Way of Life Re-Entry Project. Her non-profit provides women ex-offenders a home and helps them stay drug-free, find work, and reunite with family. The organization has provided direct service to over 1,000 women. Ms. Burton was inspired to start the organization after serving multiple drug sentences and turning her life around. Ms. Dunkle played a key role in the implementation of Title IX, guaranteeing equal opportunity to women and girls in education. Her groundbreaking 1974 report documenting discrimination against female athletes became the blueprint for the Title IX regulations on athletics. In 1975 Ms. Dunkle became the first Chair of the National Coalition for Women and Girls in Education.

Ms. Dunkle played a key role in the implementation of Title IX, guaranteeing equal opportunity to women and girls in education. Her groundbreaking 1974 report documenting discrimination against female athletes became the blueprint for the Title IX regulations on athletics. In 1975 Ms. Dunkle became the first Chair of the National Coalition for Women and Girls in Education. Ms. Ferraro was a politician, three term Congresswoman (D N.Y. 1979-85), and first woman major party candidate for Vice President (1984). President Clinton appointed her U.S. Ambassador to the United Nations Commission on Human Rights where she served from 1993-96. She also served as vice-chair of the U.S. delegation to the Fourth World Conference on Women in Beijing (1995).

Ms. Ferraro was a politician, three term Congresswoman (D N.Y. 1979-85), and first woman major party candidate for Vice President (1984). President Clinton appointed her U.S. Ambassador to the United Nations Commission on Human Rights where she served from 1993-96. She also served as vice-chair of the U.S. delegation to the Fourth World Conference on Women in Beijing (1995). Guy is a leading LGBT and women’s rights activist. She co-founded multiple organizations including the Women’s Building, La Casa de las Madres, SF Women Against Rape, and the Women’s Foundation of California. Ms. Guy was one of the LGBT activists featured in the 2017 miniseries When We Rise. She is also an advocate for women’s access to health care.

Guy is a leading LGBT and women’s rights activist. She co-founded multiple organizations including the Women’s Building, La Casa de las Madres, SF Women Against Rape, and the Women’s Foundation of California. Ms. Guy was one of the LGBT activists featured in the 2017 miniseries When We Rise. She is also an advocate for women’s access to health care. Jayaraman is Co-founder and Co-director of the Restaurant Opportunities Centers United (ROC United) and Director of the Food Labor Research Center at University of California, Berkeley. She is a leading advocate for restaurant workers, fighting for guaranteed sick and safe leave and an end the two-tiered minimum wage (a victory ROC has already won in 7 states).

Jayaraman is Co-founder and Co-director of the Restaurant Opportunities Centers United (ROC United) and Director of the Food Labor Research Center at University of California, Berkeley. She is a leading advocate for restaurant workers, fighting for guaranteed sick and safe leave and an end the two-tiered minimum wage (a victory ROC has already won in 7 states). Jiménez is Executive Director and Co-founder of United We Dream (UWD), the largest immigrant youth-led organization in the country. She was part of the team that led to the historic victory of the Deferred Action for Childhood Arrivals (DACA) program in 2012. In 2017 Jiménez was awarded a MacArthur Foundation Fellowship “Genius Grant.”

Jiménez is Executive Director and Co-founder of United We Dream (UWD), the largest immigrant youth-led organization in the country. She was part of the team that led to the historic victory of the Deferred Action for Childhood Arrivals (DACA) program in 2012. In 2017 Jiménez was awarded a MacArthur Foundation Fellowship “Genius Grant.” Langelan is a leader in the global effort to end gender-based violence and an expert in nonviolent action. Called the “godmother of direct intervention,” she pioneered feminist self-defense training, the direct-action toolkit to derail harassers at work and on the street, the first major city-wide anti-harassment campaign, and effective, comprehensive action for public transit systems. Her intervention toolkits are used around the world.

Langelan is a leader in the global effort to end gender-based violence and an expert in nonviolent action. Called the “godmother of direct intervention,” she pioneered feminist self-defense training, the direct-action toolkit to derail harassers at work and on the street, the first major city-wide anti-harassment campaign, and effective, comprehensive action for public transit systems. Her intervention toolkits are used around the world. Mayerson is Directing Attorney of the Disability Rights Education and Defense Fund (DREDF). She has been a leading force behind groundbreaking legislation including the Americans with Disabilities Act (ADA) and the Handicapped Children’s Protection Act. Ms. Mayerson has contributed to many key disability rights cases before the U.S. Supreme Court.

Mayerson is Directing Attorney of the Disability Rights Education and Defense Fund (DREDF). She has been a leading force behind groundbreaking legislation including the Americans with Disabilities Act (ADA) and the Handicapped Children’s Protection Act. Ms. Mayerson has contributed to many key disability rights cases before the U.S. Supreme Court. Moss Greenberg is a lifelong feminist activist, committed to ending social and educational inequity. She served as National Director of the National Association for Multicultural Education (NAME) where she spearheaded efforts to address intersecting forms of discrimination. Ms. Moss Greenberg also served as Founding Executive Director of the Maryland Women’s Heritage Center.

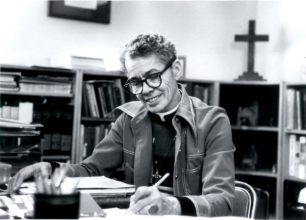

Moss Greenberg is a lifelong feminist activist, committed to ending social and educational inequity. She served as National Director of the National Association for Multicultural Education (NAME) where she spearheaded efforts to address intersecting forms of discrimination. Ms. Moss Greenberg also served as Founding Executive Director of the Maryland Women’s Heritage Center. Murray was a groundbreaking women’s rights and civil rights activist and attorney. She coined the term “Jane Crow” articulating the combined sexism and racism faced by African American women. Ms. Murray served on the Presidential Commission on the Status of Women and was a co-founder of the National Organization for Women (NOW). In 1977 Murray became the first black woman to be ordained as an Episcopal priest and she was among the first group of women to become priests in that church.

Murray was a groundbreaking women’s rights and civil rights activist and attorney. She coined the term “Jane Crow” articulating the combined sexism and racism faced by African American women. Ms. Murray served on the Presidential Commission on the Status of Women and was a co-founder of the National Organization for Women (NOW). In 1977 Murray became the first black woman to be ordained as an Episcopal priest and she was among the first group of women to become priests in that church. Peratrovich was a civil rights activist on behalf of Alaska Natives. She was a leader in the Alaska Native Sisterhood and led the fight against the pervasive Lorettadiscrimination and segregation faced by her community. Ms. Peratrovich is credited as the leading force behind passage of the Alaska territory’s Anti-Discrimination Act in 1945, the first such law in the U.S. https://www.youtube.com/watch?v=U9To3pgzh00

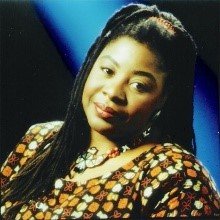

Peratrovich was a civil rights activist on behalf of Alaska Natives. She was a leader in the Alaska Native Sisterhood and led the fight against the pervasive Lorettadiscrimination and segregation faced by her community. Ms. Peratrovich is credited as the leading force behind passage of the Alaska territory’s Anti-Discrimination Act in 1945, the first such law in the U.S. https://www.youtube.com/watch?v=U9To3pgzh00 Ms. Ross is a feminist activist and leader in the reproductive justice movement. She was the Co-founder and Executive Director of the National Center for Human Rights Education and Co-founder and National Coordinator for the Sister song Women of Color Reproductive Justice Collective. In the 1970s, Ms. Ross was one of the first African American women to direct a rape crisis center. http://www.lorettaross.com/

Ms. Ross is a feminist activist and leader in the reproductive justice movement. She was the Co-founder and Executive Director of the National Center for Human Rights Education and Co-founder and National Coordinator for the Sister song Women of Color Reproductive Justice Collective. In the 1970s, Ms. Ross was one of the first African American women to direct a rape crisis center. http://www.lorettaross.com/ Salas is Executive Director of the Coalition for Humane Immigrant Rights (CHIRLA) and is a leading spokesperson for federal immigration policy reform. In C.A., she helped win in-state tuition for undocumented students and established day labor job centers that have become a national model. Ms. Salas is a coalition builder, connecting diverse groups at the state and national level.

Salas is Executive Director of the Coalition for Humane Immigrant Rights (CHIRLA) and is a leading spokesperson for federal immigration policy reform. In C.A., she helped win in-state tuition for undocumented students and established day labor job centers that have become a national model. Ms. Salas is a coalition builder, connecting diverse groups at the state and national level. Ms. Schwartz is a Vietnam veteran and activist for the rights of women veterans, testifying more than 24 times to Congress on women veterans’ issues. She served as Connecticut’s Commissioner Commandant of Veterans Affairs and was appointed by President Obama to serve as Assistant Secretary of Veteran Affairs for Policy and Planning.

Ms. Schwartz is a Vietnam veteran and activist for the rights of women veterans, testifying more than 24 times to Congress on women veterans’ issues. She served as Connecticut’s Commissioner Commandant of Veterans Affairs and was appointed by President Obama to serve as Assistant Secretary of Veteran Affairs for Policy and Planning. Each year beginning on February 1, an entire month of events are planned nationwide honoring the history and contributions of African Americans.

Each year beginning on February 1, an entire month of events are planned nationwide honoring the history and contributions of African Americans.